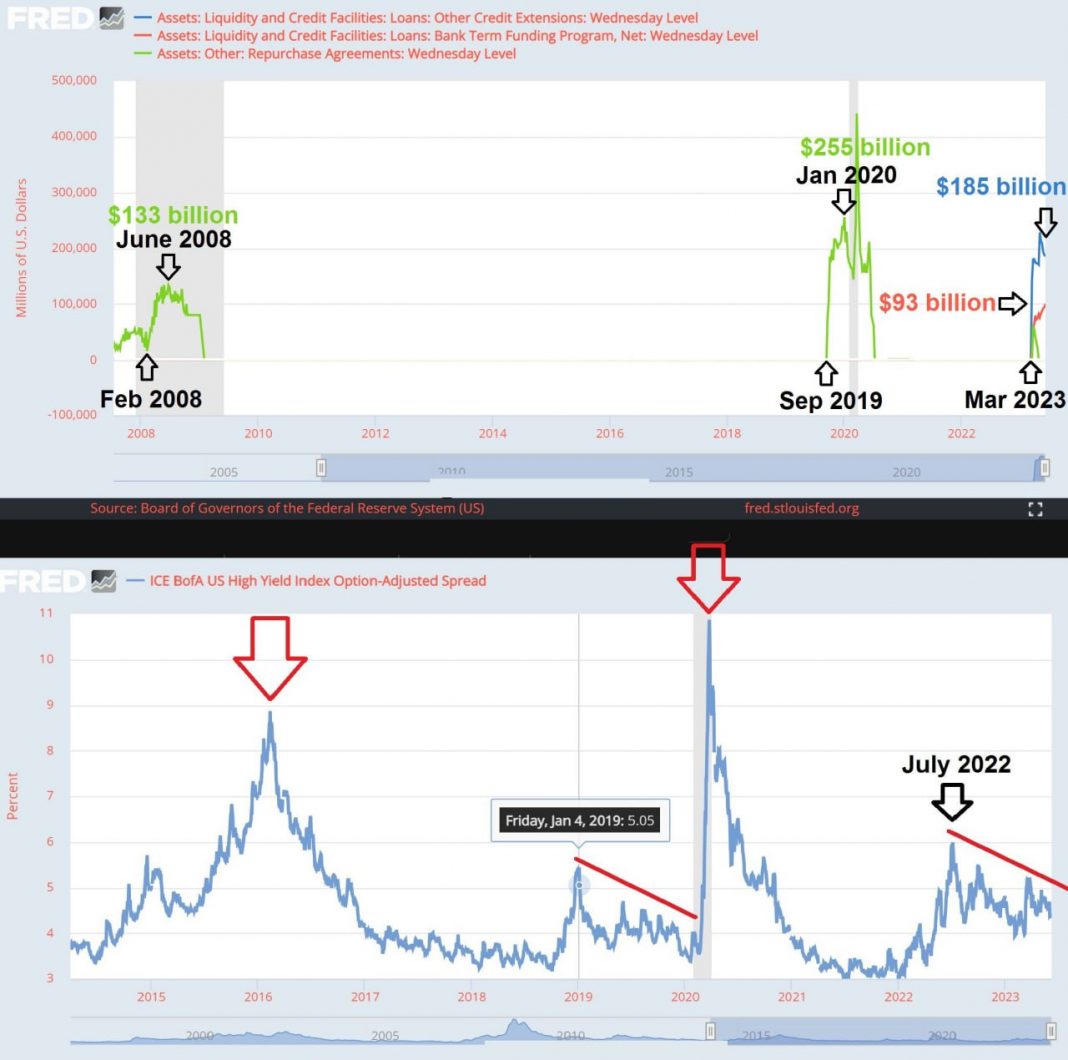

The Fed’s ability to provide liquidity to the overnight market during banking crises has allowed them to delay the collapse of the system. However, their interventions to bail out the banking sector now exceed previous years and give them complete control over when a crash occurs. The reduction in credit lines created under the Fed’s Term Financing Facility and Other Credit Extensions can indicate when the market is going to crash.