[s2If !current_user_can(access_s2member_level4)]Please register to read full post. [lwa][/s2If] [s2If current_user_can(access_s2member_level1)]

Steel is a fundamental building block of the worldwide economy, and alterations in the cost of steel can furnish clues concerning the sway in financial investments.

Frequently, trade flows can make it difficult to decipher those signals, particularly when China was flooding the US with steel. However, following the steel trade war, American production has become more focused on the domestic industry than before, which enhances its ability to gauge economic conditions more accurately.

Steel Dynamics, a major producer of steel in the US, provided an update regarding their Q2 operations today, predicting earnings that fell slightly below projected numbers. This caused a 4% decrease in the value of their shares. However, the report includes noteworthy information.

There is a significant amount of evidence indicating that this phenomenon is genuine, and substantial investments are being made in microchip foundries and related activities. The statement implies that the residential sector has experienced a slowdown, which could adversely affect steel prices. Nonetheless, this trend may be transitory given that US housing costs have remained stable, beyond initial projections, for this year. Eventually, construction must be employed to tackle the situation in the US housing industry.

A fascinating piece of information in the press release concerns inventories.

Given the bearish sentiment throughout markets and the mess in inventories during covid, I suspect this isn’t only an issue in steel service centers. If the US economy shows renewed momentum or increased confidence, we could see broader indications of re-stocking, sparking something of a virtuous cycle.

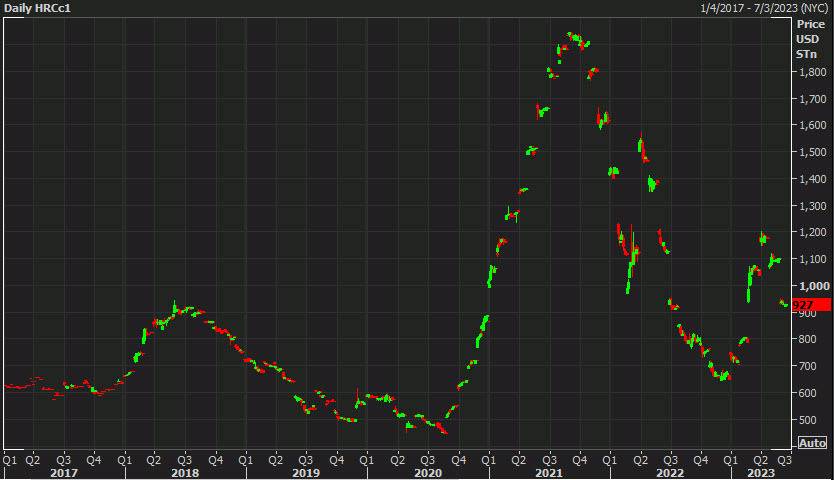

The last point to consider pertains to steel prices. While they haven’t reached the record-breaking levels seen during the covid-related supply shortages, they have evened out at $900 per ton, which is still relatively high based on past trends.

” Steel order activity remains solid from the automotive, construction, industrial, and energy sectors,” Steel Dynamics said.

[/s2If]

Telegram Group