[s2If !current_user_can(access_s2member_level4)]Please register to read full post. [lwa][/s2If] [s2If current_user_can(access_s2member_level1)]

UPCOMING EVENTS:

Monday: US Juneteenth Holiday.

On Tuesday, the People’s Bank of China (PBOC) will release its Loan Prime Rate (LPR).

On Wednesday, there will be the release of the UK Consumer Price Index and Fed Chair Powell will be giving his testimony.

On Thursday, there will be the SNB policy decision along with the BoE policy decision and the US jobless claims.

Friday: US S&P Global PMIs.

Tuesday:

The PBOC is expected to cut the 1-year and 5-year LMP rates by 10 bps following

the cuts in the 7-day reverse repo, the Standing Lending Facility and 1-year

MLF rates. These actions were taken due to the very weak performance of the

Chinese economy that prompted officials to seek more support for growth.

Wednesday:

The UK CPI Y/Y is expected to print at 8.5% vs. 8.7% prior, while the Core CPI

Y/Y is expected at 6.7% vs. 6.8% prior. This report comes just a day before the

BoE rate decision but given that it’s already widely expected that the BoE will

hike by 25 bps, it’s unlikely to see this report changing the expectations for

this meeting unless we see very big surprises.

Fed Chair Powell will testify to Congress

on the state of US monetary policy. Given that it comes just a week after his

FOMC Press Conference and that we haven’t got any top tier economic data in the

meantime, it’s unlikely that we will hear anything different.

Thursday:

The SNB is expected to hike by 25 bps bringing their interest rate to 1.75%.

The step down from 50 bps is justified by the softer CPI data where the

Headline CPI Y/Y came at 2.2% and the Core CPI Y/Y printed at 1.9%. The SNB is

very close to its 0-2% target band but given the recent Governor’s Jordan

hawkish comments after the CPI data about inflation being more persistent than

thought and that both second and third round effects are being seen, the market

expects a 25 bps increase at this meeting that may even be the last one.

It is widely predicted that the Bank of England will increase the bank rate to 4.75% by 25 basis points. Recent information regarding inflation and employment has been noteworthy, with wages growing higher than the desired 2% target. Experts anticipate that Dhingra and Tenreyro will oppose the hike, and if either of them supports the increase, it will be considered a more aggressive decision. The terminal rate expected by the market is currently at 5.25%.

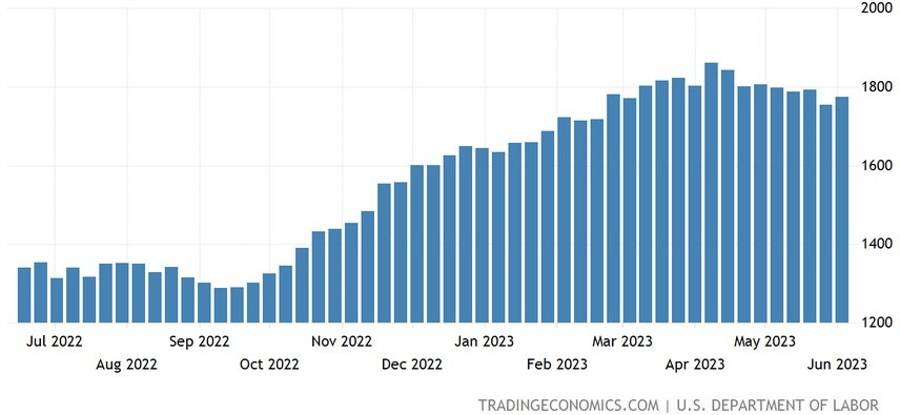

The number of US citizens submitting applications for unemployment benefits has lately been increasing and failing to meet expectations by a substantial amount for two consecutive weeks. However, the indicator of employment difficulty for the previously unemployed, known as Continuing Claims, has remained relatively consistent. While there may be some weakening in the job market, it is not yet significant enough to warrant concerns about a recession. Forecasted figures for initial claims are expected to be around 256K as opposed to the previous 262K, while continuing claims are predicted to be about 1766K in comparison to the prior 1775K.

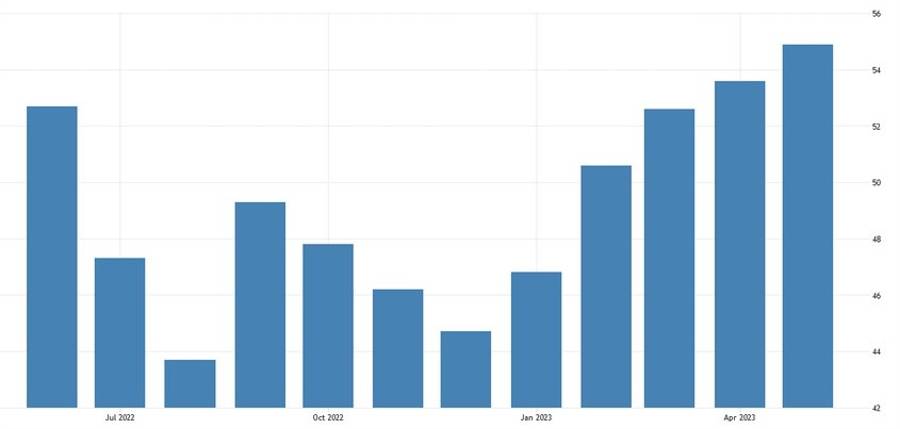

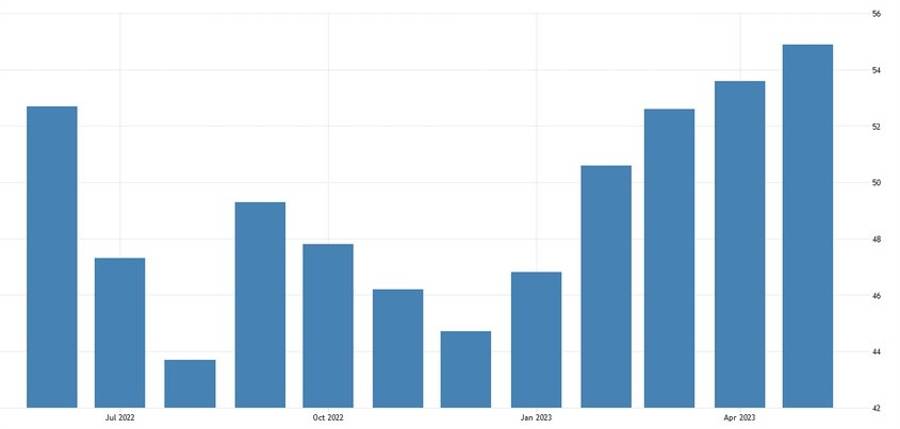

On Friday, the S&P Global US PMIs will be the key data to watch for this week. The Manufacturing PMI is anticipated to be recorded at 48.3 compared to the previous figure of 48.4, while the Services PMI is predicted to be at 54.0 versus 54.9 previously.

“Hope your week is filled with profitability!”

[/s2If]

Telegram Group