[s2If !current_user_can(access_s2member_level4)]Please register to read full post. [lwa][/s2If] [s2If current_user_can(access_s2member_level1)]

The Nasdaq’s exceptional beginning of the year was enough to make asset managers overlook the inverted yield curve.

Over the last fourteen days, managers who have the freedom to make their own investment decisions have decided to abandon strategies that had less emphasis on stocks.

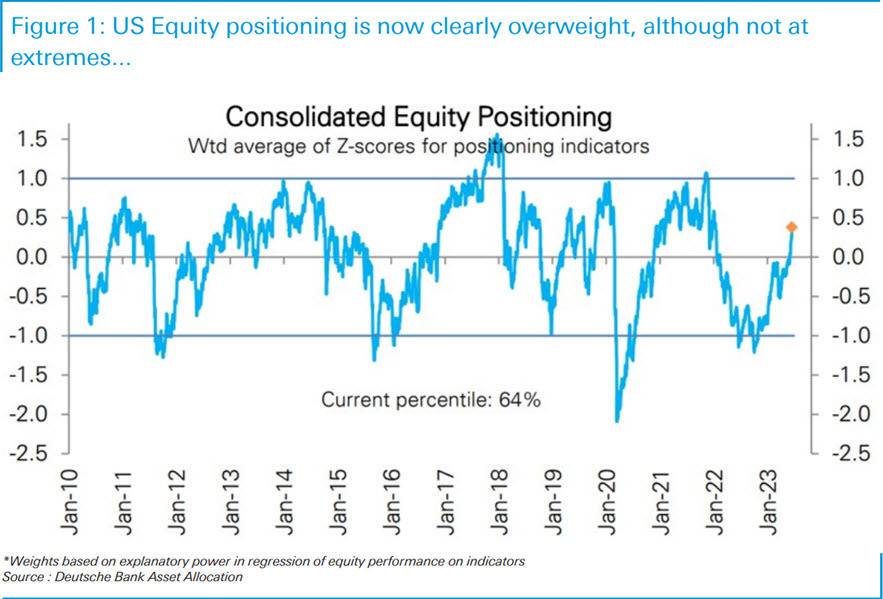

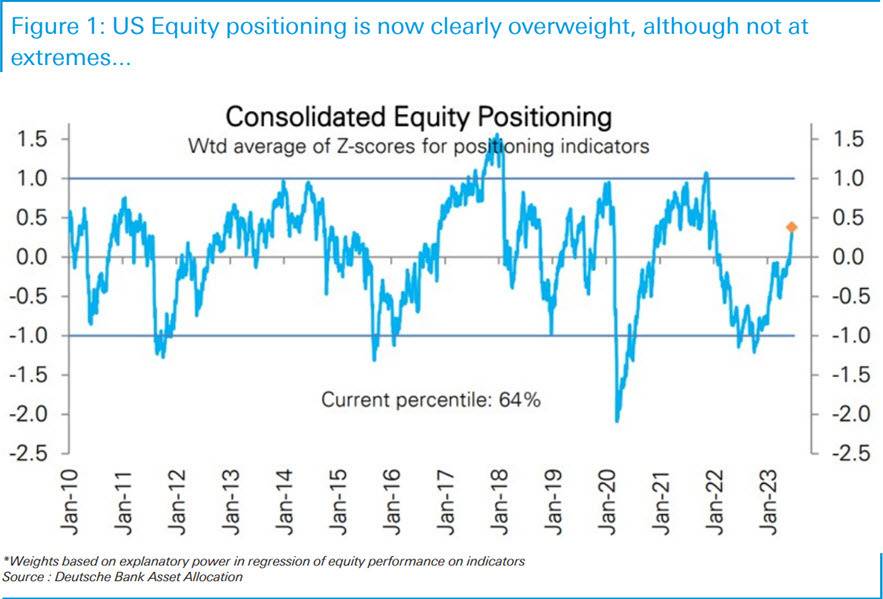

Jim Reid from Deutsche Bank notes that although we haven’t yet reached the high levels of overweight positioning seen earlier in 2022, there has been a noticeable change in sentiment in recent weeks where Fear Of Missing Out (FOMO) seems to be driving market behavior.

Although the chart indicates that there is still ample room for trading before it becomes overcrowded, the current market situation indicates that we are no longer in the initial stages of a bull market. Additionally, there are continued signals from the bond market with the Fed raising rates and the 2s/10s at -96 bps, the highest level of inversion since the peak of the bank crisis in early March, causing concern.

[/s2If]

Telegram Group