[s2If !current_user_can(access_s2member_level4)]Please register to read full post. [lwa][/s2If] [s2If current_user_can(access_s2member_level1)]

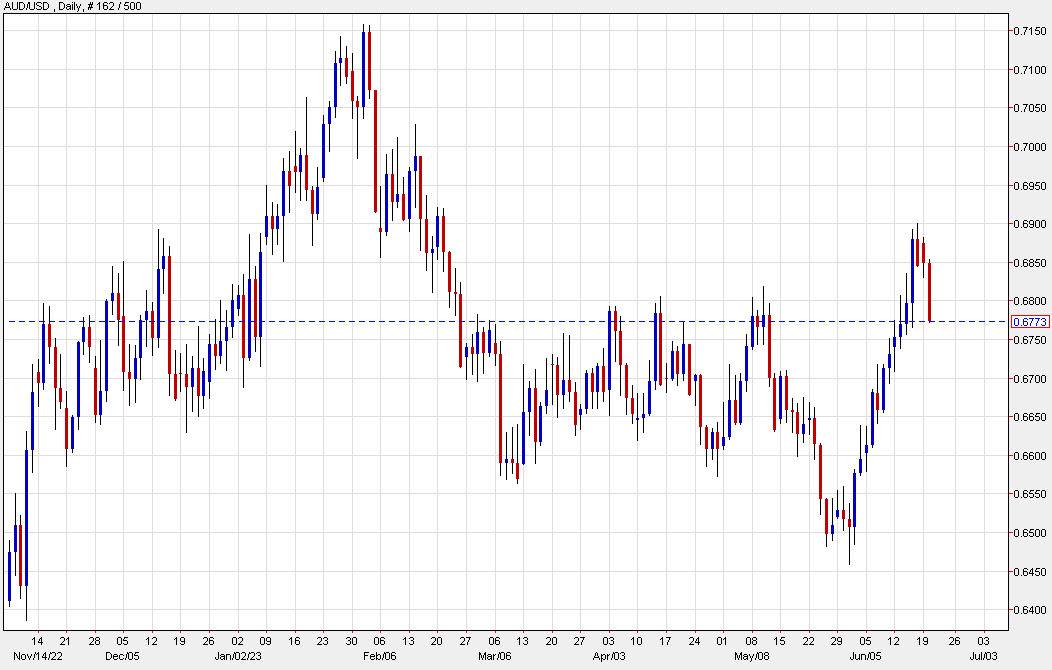

The recent increase in the value of the Australian dollar has been anticipating China’s stimulus measures for two weeks, so it’s not unexpected to witness a phenomenon of selling shortly after the support was announced. This is especially true when considering concerns over potential selling of stocks towards the end of the quarter on a global scale.

China has followed through with anticipated reductions in the 1-year and 5-year loan prime rates; however, the market is seeking further fiscal ammunition. It is also uncertain if these rate cuts are a singular occurrence or part of a larger series.

At present, the trend is to reverse the recent advancements in AUD/USD and attempt to reach the previous range high. This is a sizable development for today, but I anticipate that purchasers will still show interest, particularly as US stocks have remained relatively stable (with S&P 500 futures only decreasing by 13 points).

I am curious if the strategy typically used in the market, of being very aggressive and making a lot of noise to achieve one’s goals, will also be applied to China. While this approach has been effective in dealing with the Fed before, it has not yet been tested with China.

[/s2If]

Telegram Group