[s2If !current_user_can(access_s2member_level4)]Please register to read full post. [lwa][/s2If] [s2If current_user_can(access_s2member_level1)]

It has been a long time since US equities experienced a truly terrible day, but today’s trajectory seems to be heading in that direction. There are indications that there will be significant amounts of selling due to rebalancing flows at the end of the quarter. Additionally, this same phenomenon may be increasing demand for bonds.

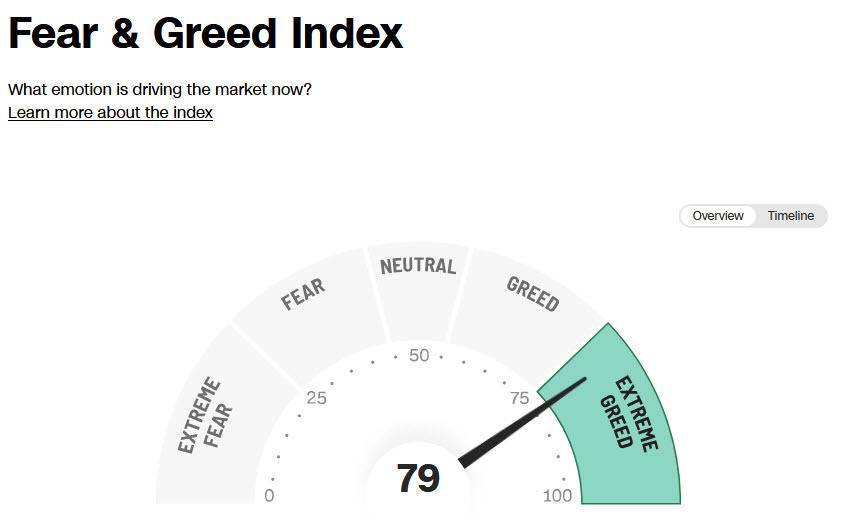

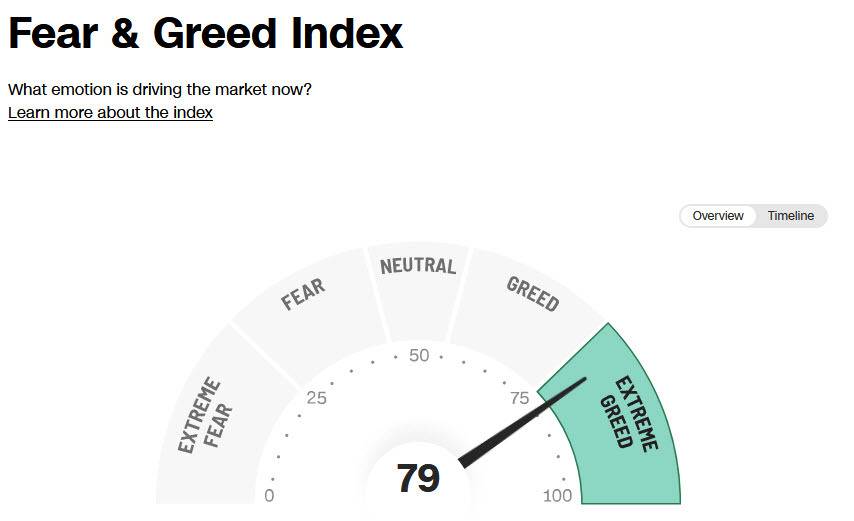

Investors are also concerned about a market that has experienced rapid growth, and the S&P 500 was only 8% from reaching a new record high when trading began today.

According to J.P. Morgan, asset managers and pension funds are predicted to sell stocks worth $150 billion by the end of the quarter to balance their portfolio with bonds. Although this amount may not be significant, it could lead to people considering the idea of earning profits in a market that has only seen an upward trend.

Up until now in this month, the trend has been to purchase stocks when their values drop, but people who follow this trend are not present today. Despite the decrease in stock prices, we have yet to reach the opening price level from Thursday.

[/s2If]

Telegram Group