[s2If !current_user_can(access_s2member_level4)]Please register to read full post. [lwa][/s2If] [s2If current_user_can(access_s2member_level1)]

The market sentiment seems to be more stable at present, although it is still the early hours of the day and we anticipate hearing from Fed Chair Powell later on. The leading currencies are not experiencing much activity, and the US futures market is showing minimal fluctuations following a slightly slow performance yesterday.

The situation will become slightly challenging while entering Europe, as traders will also have to consider the notion of shifting their investment risks before the end of the month and quarter.

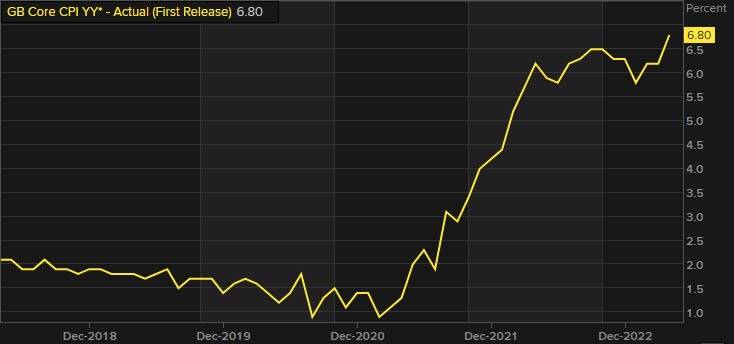

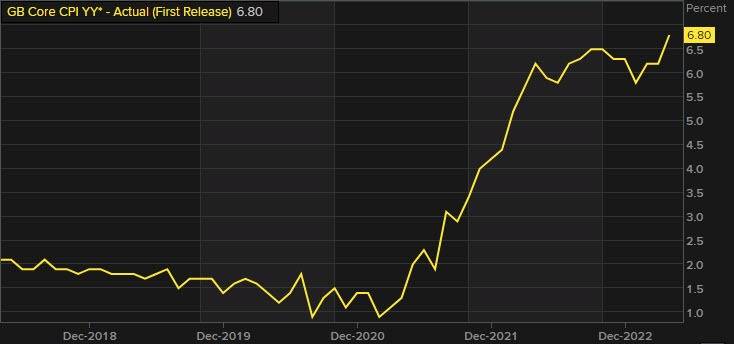

In the future, the UK inflation data will need to be addressed, but it will only confirm the likelihood of a rate increase from the BOE. It is anticipated that the core yearly inflation will stay at 6.8% in May, which supports the notion that there are still substantial price pressures in the UK.

According to OIS pricing, there is a 100% expectation of a 25 basis point interest rate increase this week, and I believe this expectation will remain unchanged even with any incoming data. What is crucial for the pound and UK rates at present is the final pricing. This is estimated to be around 5.83%, indicating that there is still a considerable way to go as the current bank rate is at 4.50%.

Regardless, pay attention to the price fluctuations in the upcoming session as the pound will react to the data.

At 6:00 AM Greenwich Mean Time, the UK will release May’s Consumer Price Index figures. At 10:00 AM GMT, the UK will release June’s Confederation of British Industry Trends total order figures. At 11:00 AM GMT, the United States will release the Mortgage Bankers Association’s mortgage applications data for the week ending June 16th.

The session ahead has come to an end. I hope you have a great upcoming day and successful trades. Remember to stay safe.

[/s2If]

Telegram Group