[s2If !current_user_can(access_s2member_level4)]Please register to read full post. [lwa][/s2If] [s2If current_user_can(access_s2member_level1)]

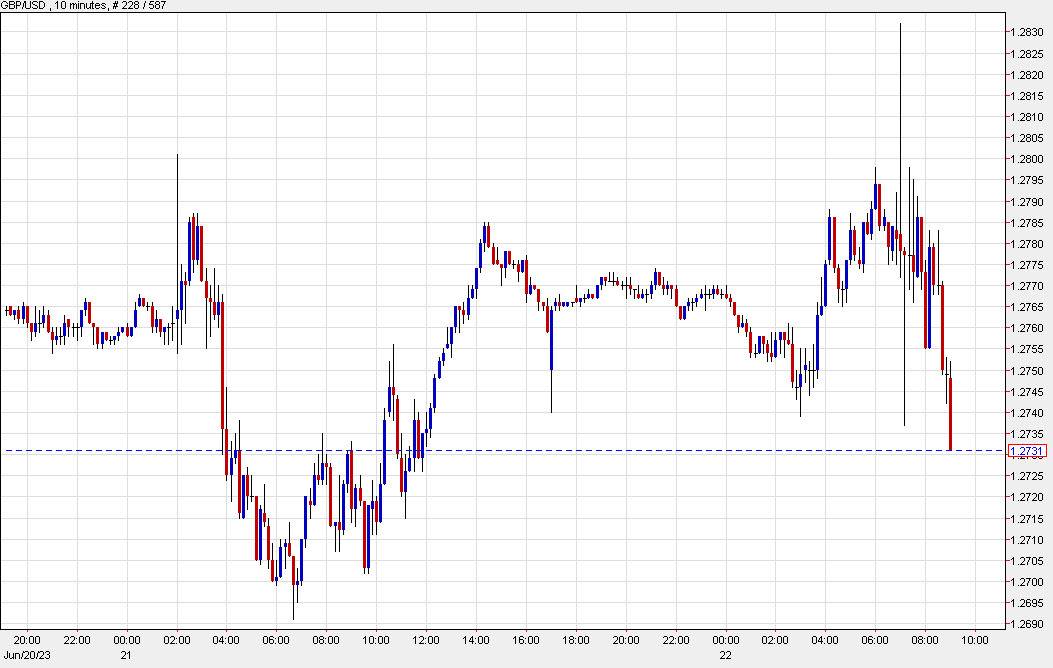

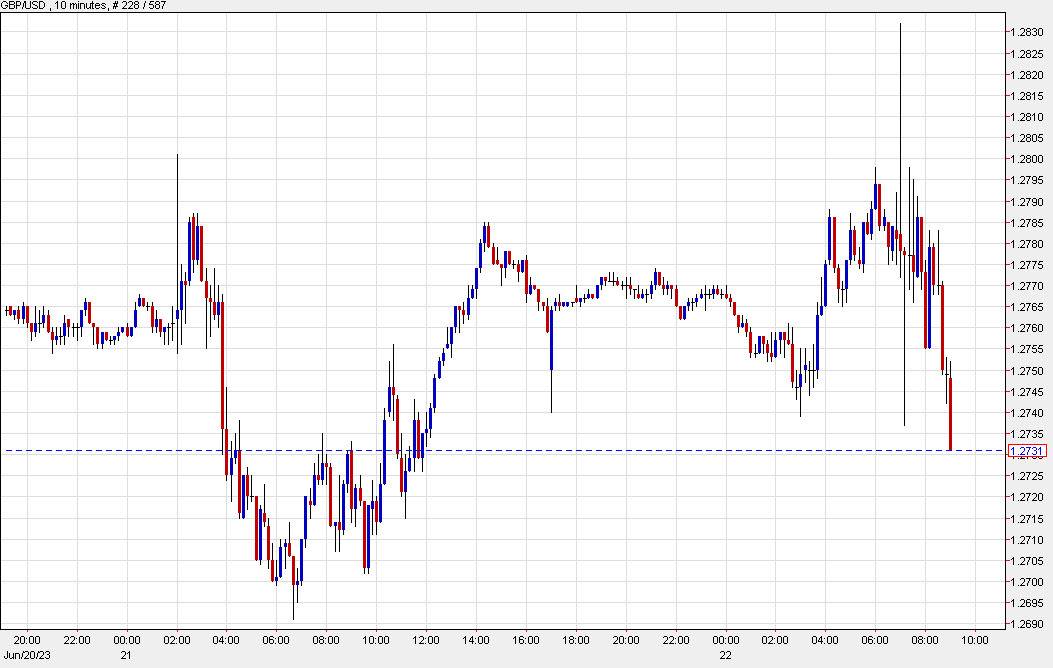

There has been some slight stress on the pound currency due to the unexpected decision by the Bank of England to increase the bank rate by 50 basis points, resulting in it reaching 5.00%.

Typically, an increase in interest rates would have a positive effect on a currency’s value because it increases returns. However, in this situation, there are two factors that are causing the pound to be negatively impacted.

Hiking rates was already anticipated for a later time, so the recent development is more about a shift in timing than a completely unexpected event. However, there has been a legitimate change as the expected final rate by markets has also increased slightly.

Increasing hiking efforts by the Bank of England may result in deeper cuts in the future. With today’s economic shock, the United Kingdom is at a greater risk of entering a recession, and the market is analyzing the possibility that the Bank of England may have to induce a challenging recession to manage inflation. Essentially, investors are avoiding economies that are contracting, as reflected in the depreciating value of GBP. Additionally, an unforeseen negative event may occur if or when interest rates reach 6%, which was displayed last year with the liability-driven investment debacle.

The US dollar is becoming stronger across all areas as risk aversion increases.

[/s2If]

Telegram Group