[s2If !current_user_can(access_s2member_level4)]Please register to read full post. [lwa][/s2If] [s2If current_user_can(access_s2member_level1)]

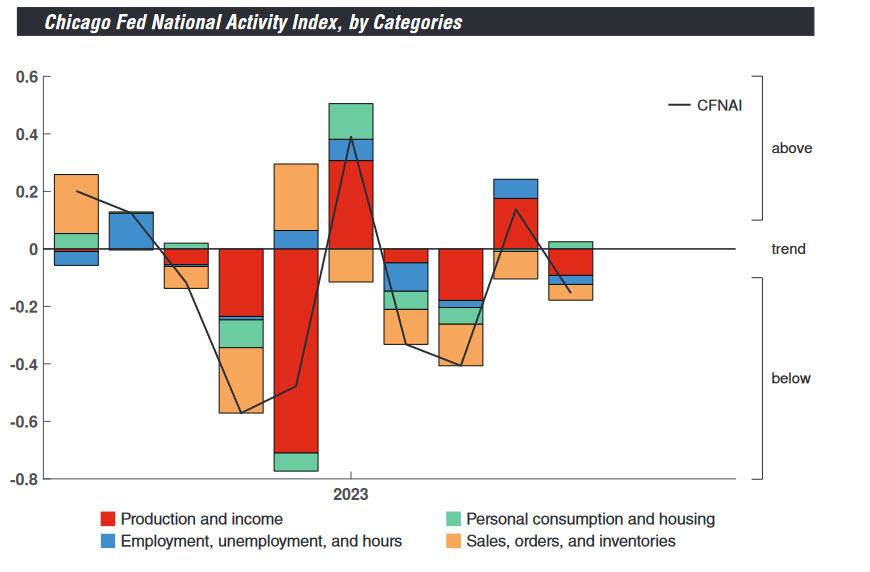

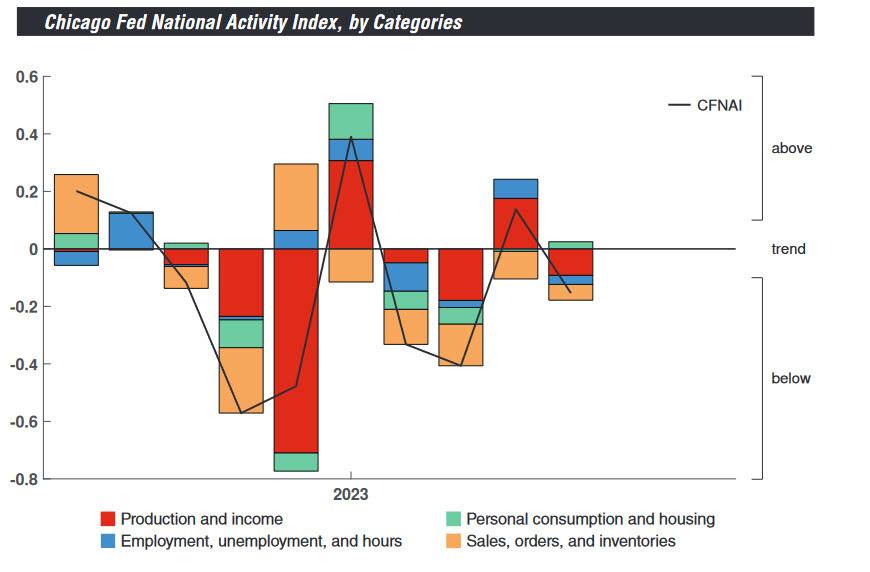

In May, the Chicago Fed National Activity Index (CFNAI) decreased to -0.15 from its April level of +0.14 primarily due to a decrease in production-related indicators. Out of the four categories of indicators that influence the index, two fell in May, with three making negative contributions. However, the three-month moving average CFNAI (CFNAI-MA3) showed improvement, rising to -0.14 from -0.20 in April. Additionally, the CFNAI Diffusion Index increased to -0.09 in May from -0.14 in April. In terms of individual indicators, 39 made positive contributions and 46 had negative impacts. Key drivers of the CFNAI in May were production and employment-related indicators, which fell from their April levels, while the personal consumption and housing category’s contribution slightly improved.

The national activity index created by the Chicago Fed is not likely to have a significant impact on the financial market, but it provides a reasonable indication of the trajectory of the economy. The index is composed of 85 growth indicators selected from four major data categories: production and income; employment including unemployment and hours; personal consumption and housing; and sales, orders, and inventories.

[/s2If]

Telegram Group