[s2If !current_user_can(access_s2member_level4)]Please register to read full post. [lwa][/s2If] [s2If current_user_can(access_s2member_level1)]

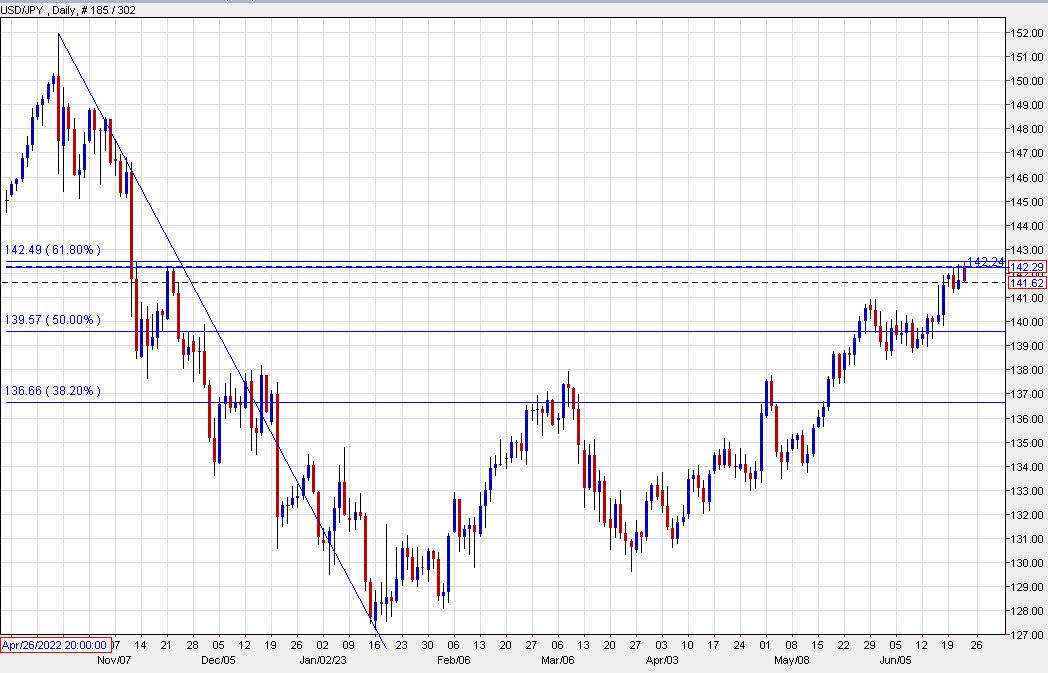

The USD/JPY saw a surge in value, exceeding a significant resistance level due to increased long-term US yields. This prompted broad USD purchasing and the pair gained 36 pips, reaching a brief high of 142.45.

Taking a wider view of the chart would be beneficial as it emphasizes the significant levels that are currently in action. The 142.24 level indicates the peak in November 2022, which was a substantial recovery following the decline after the intervention and the CPI peak. It is also located near the 61.8% retracement point from the decline that occurred earlier this year.

It can be argued that if USD/JPY manages to exceed these boundaries, it will have a straightforward route to return to the 150 area.

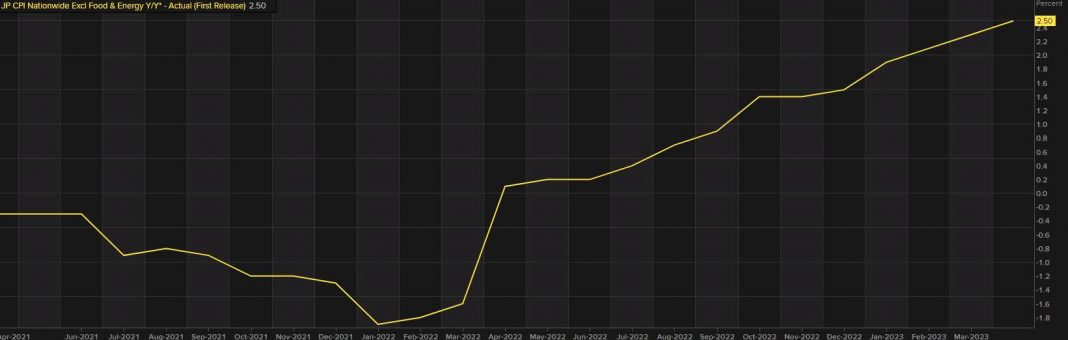

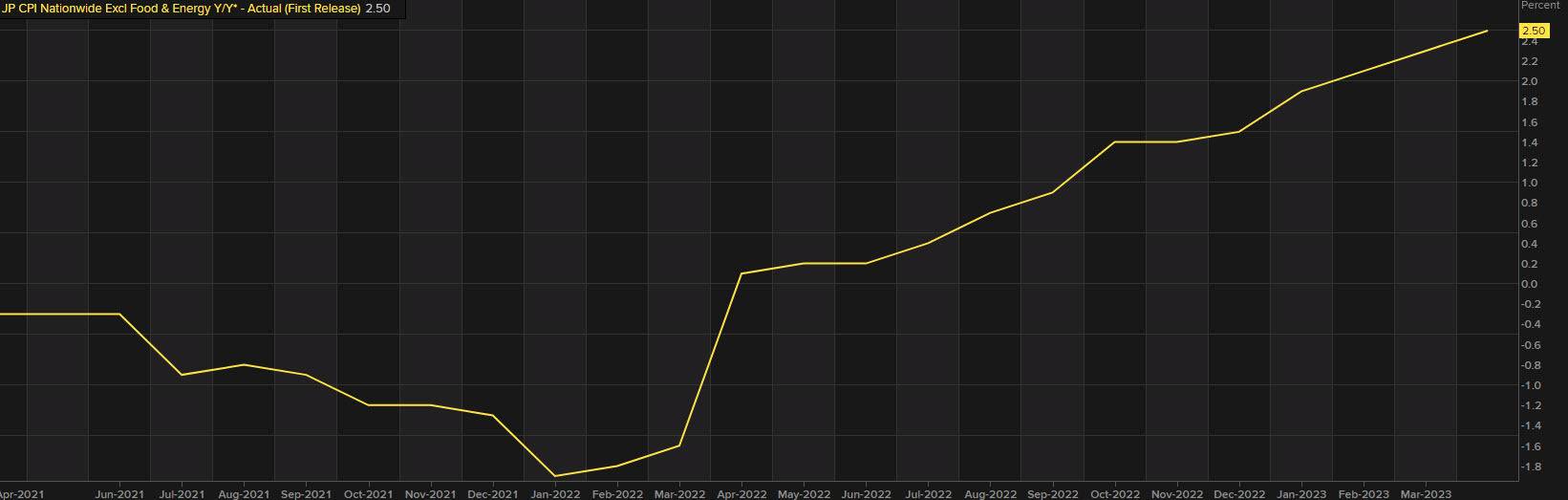

There is a significant danger associated with the idea of a stronger USD/JPY due to the probability that the Bank of Japan may have to give up on controlling the yield curve. The inflation rate is gradually increasing, and despite the Bank of Japan’s claims of upcoming deflation, a declining currency will not aid the situation.

It’s important for traders to remember that risk assets may decrease in value, causing people to seek safer options due to concerns about a recession or market instability. This could result in the USD/JPY currency pair being negatively affected and cause the yen to become stronger overall. Recent actions from central bankers may indicate a greater risk of a recession occurring in 2024. If investors sense an impending economic downturn, it may cause significant losses for those involved in USD/JPY trading.

It is worth mentioning that the first 14 days of July are considered the most favorable time to possess stocks, and this is expected to provide a boost to the USD/JPY exchange rate.

[/s2If]

Telegram Group