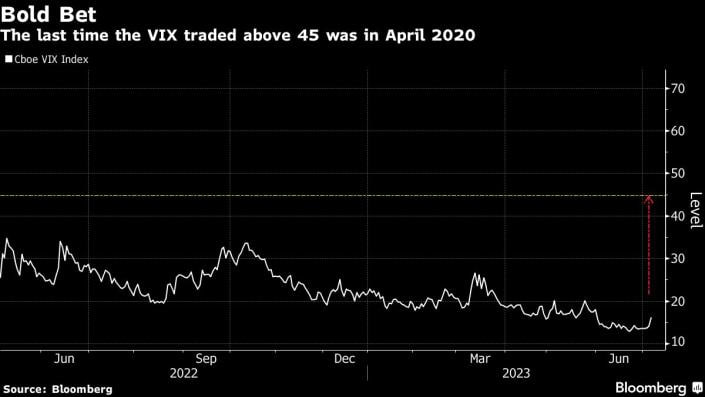

A person has made a significant bet on a threefold increase in the VIX index within the next few months, indicating a potential sharp deterioration in the market conditions. Despite the current lack of market reaction, the situation can always change. The bet involved purchasing 83,000 call options worth $4.5 million with an expiration date of October 1st. To offset the cost, 27,700 calls were sold simultaneously at a exercise price of 27 and the same expiration date. Although the deal’s value is only $650k due to opposing contracts, there is still a chance for profitability if volatility rises even slightly in the fall, considering the current trading levels of the VIX.