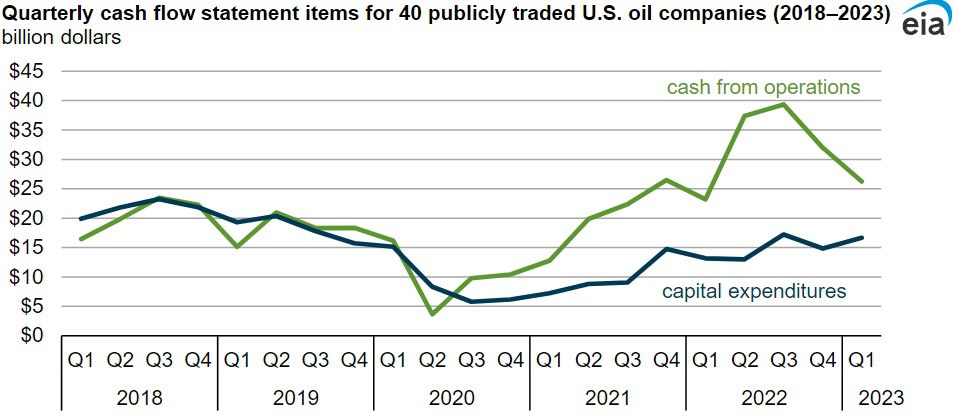

The shale drilling industry in the United States is facing significant challenges and a potential decline in oil production. Major oil companies are not investing enough in capital, resulting in decreased production capacity. The profitability of new drilled wells is diminishing, making it difficult for the US to increase production. These issues may lead to a reduction in oil production by the end of the year. However, if oil prices reach levels above $100 per barrel, it could incentivize drilling in currently unprofitable or low-margin areas. Nonetheless, the industry will require up to a year to reach commercial drilling rates, and production growth will be slower compared to previous shale booms.