[s2If !current_user_can(access_s2member_level4)]Please register to read full post. [lwa][/s2If] [s2If current_user_can(access_s2member_level1)]

Steel forms the physical foundation on which the global economy is built, and the way steel prices fluctuate may give us some indication of investment robustness.

Frequently, those indications may be unclear due to trade movements, particularly when China was flooding the US market with steel. However, after the steel trade conflict, American production has become more focused on domestic operations, which improves its effectiveness as an economic gauge.

Steel Dynamics, a major US steel producer, provided an update on their Q2 operations today. They predicted that their earnings would be slightly lower than what was expected, causing their shares to decrease by 4%. However, the report contains important information that is worth noting.

There is a lot of evidence indicating that this phenomenon is indeed happening, as evidenced by the significant investment in microchip production centers and other related operations. However, it should be noted that the residential sector has seen a slowdown, which could negatively affect steel prices – although this situation might only be temporary given that the housing market in the US has performed better than anticipated this year. Eventually, the US will need to address its housing issue through construction.

Another noteworthy piece of information mentioned in the press release pertains to the inventories.

I believe that the steel service centers are not the only ones facing the negative attitude prevailing in the markets and the inventory challenges posed by Covid-19. If there is an improvement in the US economy, accompanied by greater trust in it, there may be a more widespread tendency to replenish stocks, creating a positive chain reaction.

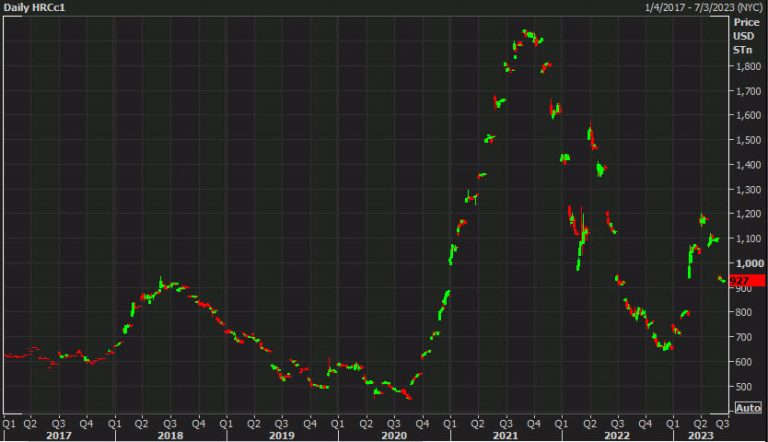

Finally, there’s the message from steel prices. Though they’re far from the all-time highs during covid shortages, they’ve stabilized at $900/ton. Historically, those are high prices.

According to Steel Dynamics, the demand for steel remains strong across automotive, construction, industrial, and energy industries.

[/s2If]

Telegram Group