[s2If !current_user_can(access_s2member_level4)]Please register to read full post. [lwa][/s2If] [s2If current_user_can(access_s2member_level1)]

In a previous article this month, I discussed the resilience of Canadian housing prices, despite the presence of high interest rates and a heavily indebted consumer base.

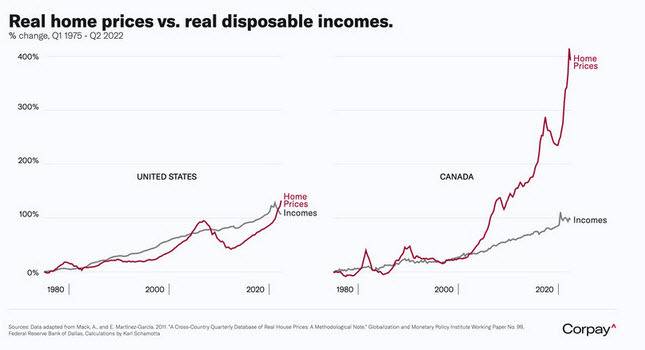

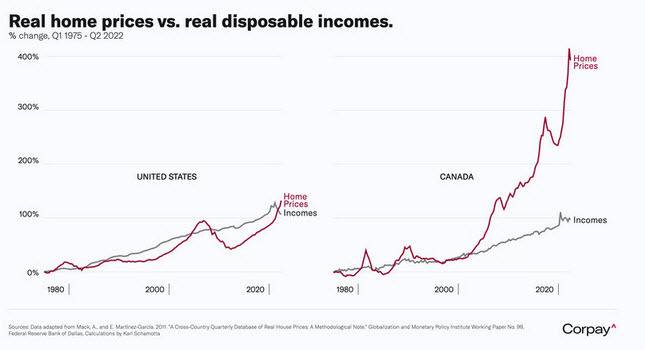

Over the past two decades, Canadian housing prices have significantly outperformed those in the United States.

The problem, simply is that Canada doesn’t have enough homes. The country is adding 1 million people per year and isn’t building nearly enough homes in large part due to draconian regulations.

“Presently, CIBC delves further into an issue that I believe will eventually bring down governments across the nation. Would you like to hear about it?”

The issue commences due to the shortage of laborers in the construction field and, according to those who work in the industry, the decrease in efficiency among existing employees. Furthermore, it is distressing that the proportion of construction workers aged over 55 years has escalated to 20%, in contrast to 12.5% at the start of the 21st century.

Trudeau has recommended increasing immigration as a remedy for the scarcity of construction workers. However, Canada’s immigration policies heavily prioritize professionals in white-collar occupations. Consequently, only a small percentage of new immigrants, which is currently 2.0% but decreasing, end up working in the construction sector.

When you consider the full picture, it becomes clear that there is a serious issue with housing that could persist for multiple generations and may take many years to resolve. What’s even more concerning is that the Bank of Canada seems determined to alleviate the issue by placing an undue burden on those who have taken out mortgages, rather than addressing the problem of insufficient available housing.

[/s2If]

Telegram Group