[s2If !current_user_can(access_s2member_level4)]Please register to read full post. [lwa][/s2If] [s2If current_user_can(access_s2member_level1)]

The market’s disposition appears to be more consistent presently, but it’s still early in the day and we have yet to hear from Fed chair Powell in his testimony later. The top currencies are remaining relatively stagnant and US futures are showing minimal changes after a somewhat dull performance yesterday.

This situation will result in some financial constraints for traders when entering Europe, and they will also need to consider the possibility of a shift in risk before the end of the month or quarter.

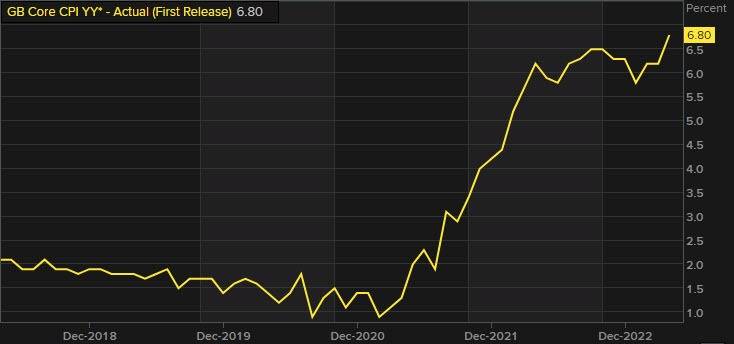

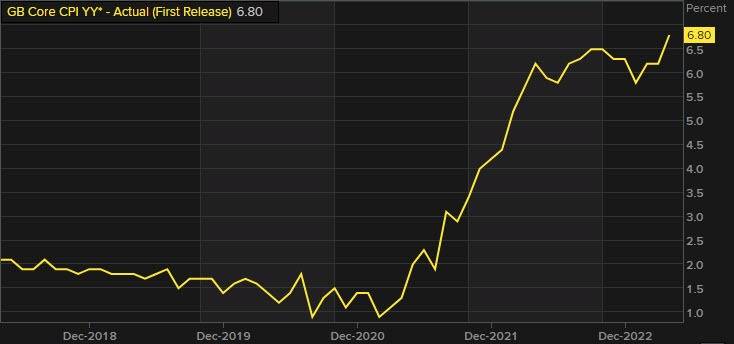

Looking ahead, there will be UK inflation data to contend with but it should just reaffirm continued prospects of a rate hike by the BOE. Core annual inflation is expected to remain at 6.8% in May and that will feed into the narrative that price pressures are not relenting yet in the UK.

According to OIS pricing, a 25 basis point increase in interest rates is already fully expected for this week and it is unlikely to change, regardless of new information. The focus now for the value of the pound and UK interest rates is on the terminal pricing, which is estimated to be around 5.83%. This means that there is still a significant distance to go before reaching the current bank rate of 4.50%.

Regardless, the data will affect the pound significantly, thus it’s advisable to pay close attention to any changes in value during the upcoming session.

At 6:00 AM Greenwich Mean Time, the figures for the UK’s May Consumer Price Index will be released. At 10:00 AM GMT, the data for the UK’s June Confederation of British Industry trends. At 11:00 AM GMT, the statistics for US Mortgage Bankers Association mortgage applications will be published for the week ending on June 16th.

The upcoming session has come to an end. I hope you have favorable days ahead and prosperous trading. Keep yourself protected.

[/s2If]

Telegram Group