[s2If !current_user_can(access_s2member_level4)]Please register to read full post. [lwa][/s2If] [s2If current_user_can(access_s2member_level1)]

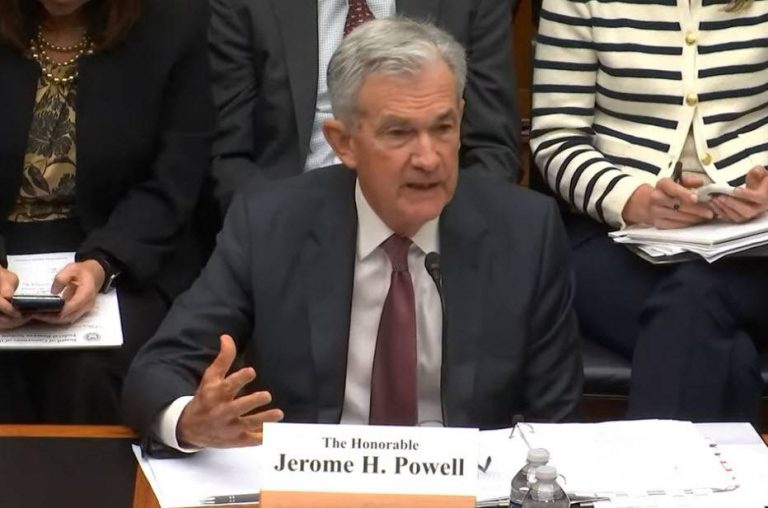

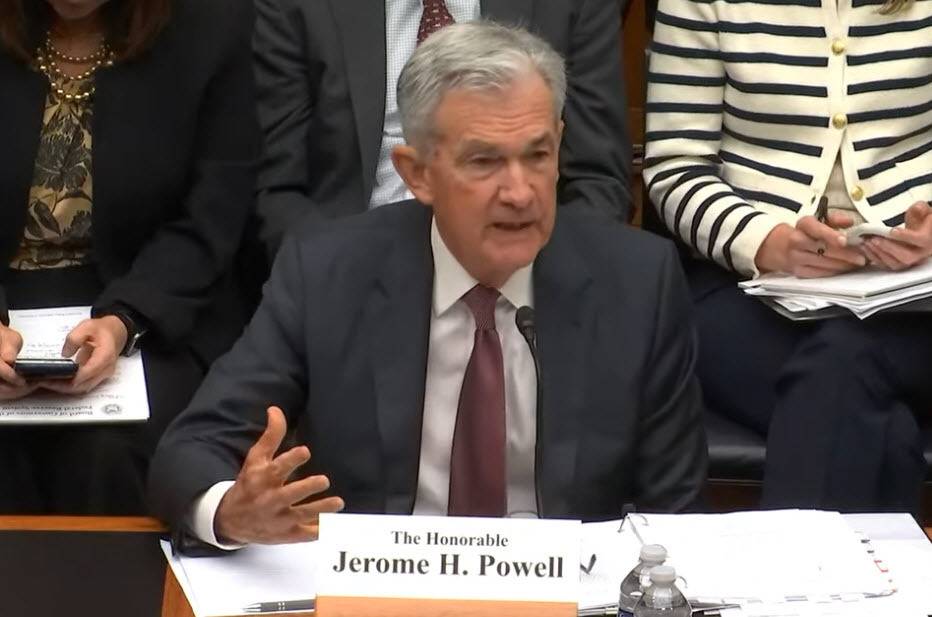

The likelihood of a Fed rate increase for the July 26 meeting is suggested to be 76%, which hasn’t changed much since Powell’s speech. Essentially, Powell supported the market’s expectations and emphasized that future decisions will be made on a meeting-by-meeting basis. However, he also pointed out that almost all FOMC members predict that there will be more rate increases before the year’s end.

During his testimony, the value of the dollar decreased and it is now at its lowest point of the trading session. This caused the euro to increase by 55 pips, reaching 1.0970 for the day.

It should be recognized that Powell’s activities are not the only significant event taking place today. According to Goolsbee, a member of the Fed, the most recent decision made by the Fed was a “close call” for him. This implies that he may resist future increases in interest rates.

The UK inflation report had surprising results as core CPI was 7.1%, higher than the expected 6.8%. This highlights the increasing likelihood that the Bank of England’s final interest rate will end up being higher than that of the Fed.

It is possible that we are witnessing quarter-end flows in action. The decline in Treasury yields and the decline in tech stocks indicate a certain level of rebalancing in response to the strong Q2 trends.

[/s2If]

Telegram Group