[s2If !current_user_can(access_s2member_level4)]Please register to read full post. [lwa][/s2If] [s2If current_user_can(access_s2member_level1)]

The JP Morgan preview of the Bank of England reveals that the BoE, which is owned by the British government and established in 1694, functions as the central bank of the United Kingdom and plays a significant role in determining monetary policy in Europe. Its main responsibility is to maintain and target interest rates while using other tools to influence the economy. Additionally, the BoE is in charge of producing bank notes in the UK and overseeing important bank payment systems. A Monetary Policy Committee meeting is scheduled for 22 June 2023.

Correct. Justin phrased it perfectly.

JP Morgan also expressed a sense of hopelessness regarding the future of the UK citizens, with less of a foretelling and more of a lamentation.

The Bank of England finds itself in a difficult position as other central banks around the world, with the exception of the Bank of Japan, have had to take drastic measures to increase interest rates in order to combat inflation. However, the Brexit situation has made the job of the Bank of England much more challenging as it has worsened supply chain issues and negatively impacted the UK economy.

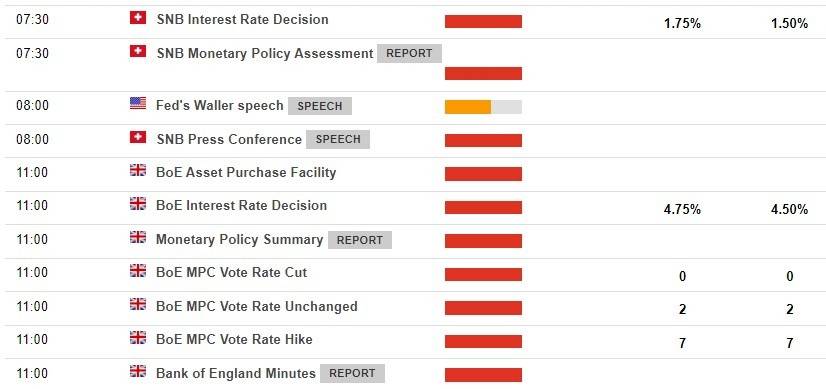

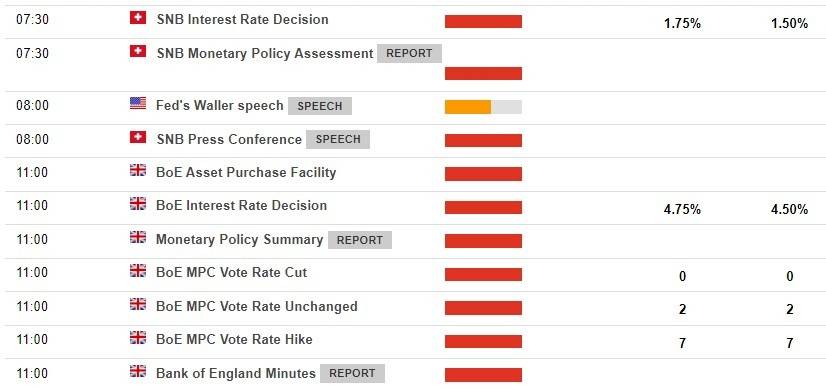

The decision of the Bank of England Monetary Policy Committee will be made public at 1100 GMT, equivalent to 0700 US Eastern time.

Today, the Swiss National Bank will be appearing at 0730 GMT or 0330 US Eastern time.

Previews regarding the Swiss National Bank:

[/s2If]

Telegram Group