[s2If !current_user_can(access_s2member_level4)]Please register to read full post. [lwa][/s2If] [s2If current_user_can(access_s2member_level1)]

As for the remaining probabilities, they are in favor of a 50 basis points alteration. It should be noted that, at one stage yesterday, those same probabilities were nearly reversed subsequent to the release of the UK’s strong inflation statistics, as depicted in the link provided.

Consequently, individuals who were anticipating a more aggressive action from the BOE may find a 25 bps shift underwhelming. Nevertheless, there could be some leeway if Bailey and colleagues prepare the ground for a more rigid discourse before August.

Presently, approximately 67 basis points of interest rate increases are anticipated within the upcoming two meetings. This indicates the chance of one meeting, either today or in August, where a potential 50 basis point interest rate increase may occur. Consequently, if policymakers express a strongly assertive stance, the disappointment for those optimistic about the pound will not be as significant.

Conversely, in the event that the BOE unexpectedly increases the bank rate to 5.00%, by 50 bps, it will be greatly unsatisfactory for those who were anticipating a more cautious policy. As a result, UK rates and the value of the pound are expected to rise rapidly, while the stock market will suffer a considerable setback in my opinion.

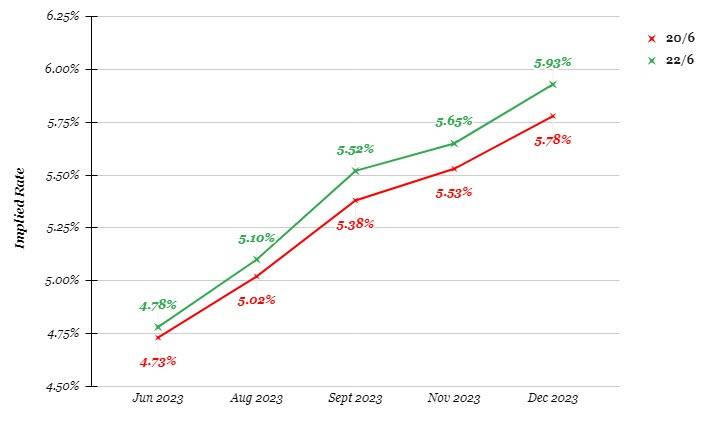

This is how the OIS rates curve for the BOE bank rate has progressed from before yesterday’s CPI figures up to its current state ahead of the BOE today.

As was discussed yesterday, traders anticipate that interest rates will remain elevated for an extended period, with a projected peak for the bank rate of 5.93% in March 2024. This represents an increase from the previous week’s projection of 5.83%, but is a moderation from the peak projection of 6.01% following the release of this week’s CPI data.

[/s2If]

Telegram Group