[s2If !current_user_can(access_s2member_level4)]Please register to read full post. [lwa][/s2If] [s2If current_user_can(access_s2member_level1)]

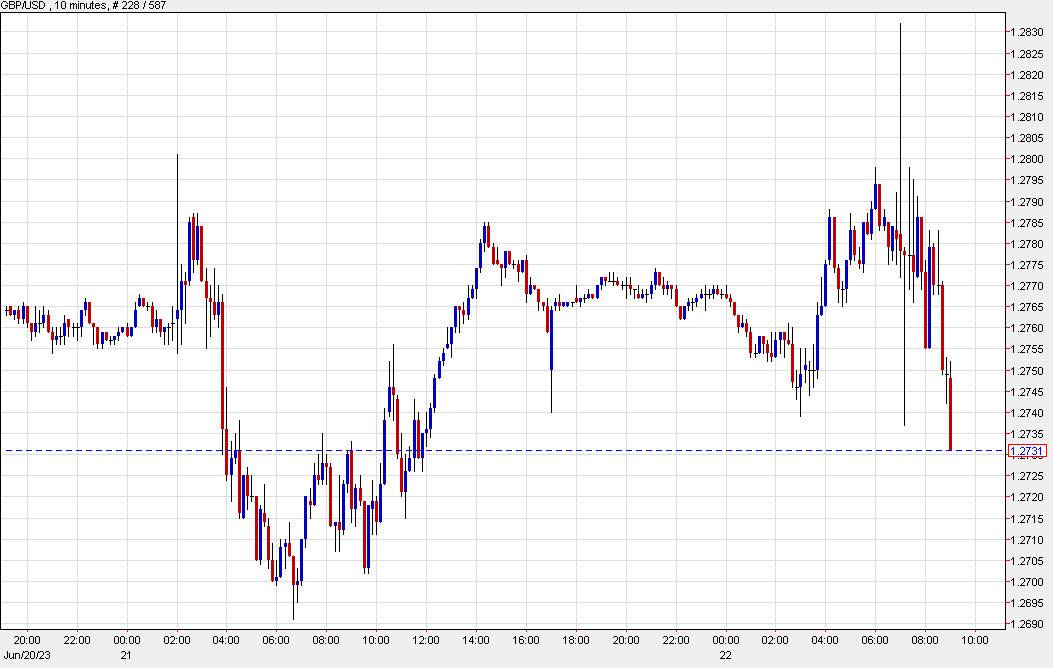

The Bank of England’s unexpected decision to raise the bank rate to 5.00% by 50 basis points has caused the pound to experience slight pressure.

Typically, when interest rates are raised, a currency becomes stronger due to increased yields. However, in the current situation, there are two factors that are causing the pound to weaken.

Although hikes were anticipated to occur later, this alteration is more related to the timing rather than being an actual shock. Nonetheless, the estimated terminal rate enforced by the markets has also increased, signifying a real difference.

2) If the Bank of England increases hiking rates now, it may need to reduce them more drastically later. The recent market shock has increased the likelihood of a UK recession, and investors are anticipating that the BOE may have to take drastic measures to combat inflation. Ultimately, a shrinking economy will deter capital flow, which is reflected by the value of GBP today. Additionally, there is a risk of an unpredictable event adversely affecting the economy when rates reach 6%, as seen in the liability-driven investment crisis last year.

Furthermore, the strength of the US dollar is also a factor as it reaches new highs during the trading session due to concerns about risk.

[/s2If]

Telegram Group