Login to view

[s2If !current_user_can(access_s2member_level1)][lwa][/s2If] [s2If current_user_can(access_s2member_level1)]

| Website | bitcoin.org | Whitepaper | ||||

| Explorers | Blockchair | |||||

| Wallets | Crypto.com – DeFi Wallet | Ledger | Trezor | Electrum | Xdefi | Trust Wallet |

| Community | bitcointalk.org | |||||

| Search on | ||||||

| Source Code | Github |

Description

What is Bitcoin?

Bitcoin is a cryptocurrency. It is a decentralized digital currency that is based on cryptography. As such, it can operate without the need of a central authority like a central bank or a company. It is unlike government-issued or fiat currencies such as US Dollars or Euro in which they are controlled by the country’s central bank. The decentralized nature allows it to operate on a peer-to-peer network whereby users are able to send funds to each other without going through intermediaries.

For more information on Bitcoin, do read CoinGecko’s How to Bitcoin book.

Who created Bitcoin?

The creator is an unknown individual or group that goes by the name Satoshi Nakamoto with the idea of an electronic peer-to-peer cash system as it is written in a whitepaper. Until today, the true identity of Satoshi Nakamoto has not been verified though there has been speculation and rumor as to who Satoshi might be.

When was Bitcoin launched?

It was launched in January 2009 with the first genesis block mined on 9th January 2009.

How does Bitcoin work?

While the general public perceives Bitcoin as some kind of physical looking coin, it is actually far from that. Under the hood, it is actually a distributed accounting ledger that is stored in a form of a chain of blocks, hence the name blockchain.

In a centralized system like the ones operated by a commercial bank, given a situation where Alice wants to transact with Bob, the bank is the only entity that holds the ledger that describes how much balance Alice and Bob has. As the bank maintains the ledger, they will do the verification as to whether Alice has enough funds to send to Bob. Finally when the transaction successfully takes place, the Bank will deduct Alice’s account and credit Bob’s account with the latest amount.

Bitcoin conversely works in a decentralized manner. Since there is no central figure like a bank to verify the transactions and maintain the ledger, a copy of the ledger is distributed across Bitcoin nodes. A node is a piece of software that anybody can download and run to participate in the network. With that, everybody has a copy of how much balance Alice and Bob has, and there will be no dispute of fund balance.

Now, if Alice were to transact with Bob using bitcoin. Alice will have to broadcast her transaction to the network that she intends to send $1 to Bob in equivalent amount of bitcoin. How would the system be able to determine that she has enough bitcoin to execute the transaction and also to ensure she does not double spend that same amount.

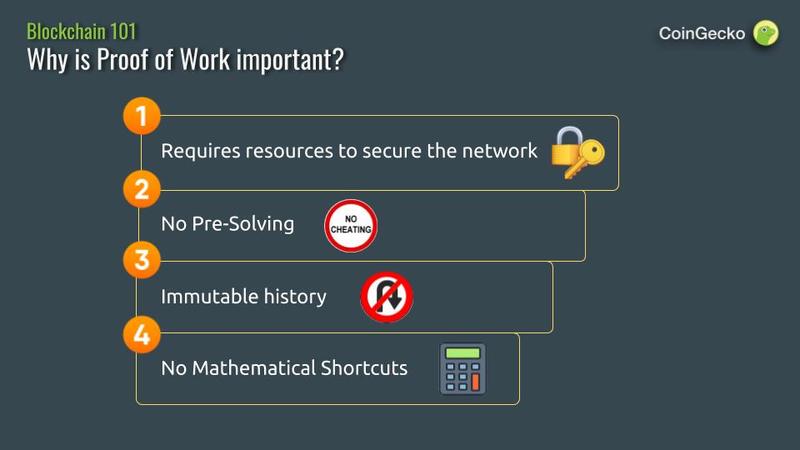

Here is where mining takes place. A Bitcoin miner will use his or her computer rigs to validate Alice’s transaction to be added into the ledger. In order to stop a miner from adding any arbitrary transactions, they will need to solve a complex puzzle. Only if the miner is able to solve the puzzle (called the Proof of Work), which happens at random, then he or she is able to add the transactions into the ledger and the record is final.

Since running these computer rigs cost money due to capital expenditure for buying the rigs and the cost of electricity, miners are rewarded with new supply of bitcoins that is part of its monetary system and some amount of fees paid by the person who wishes to transact (in this case it is Alice).

This makes the Bitcoin ledger resilient against fraud in a trustless manner. While it is resilient, there are still some risks associated with the system such as the 51% attack where by miners control more than 51% of the total computation power and also there can be security risks outside of the control of the Bitcoin protocol.

To learn more about Bitcoin (BTC), you may:

-

Watch an article on Bitcoin’s DeFi ecosystem. -

Read an article on Bitcoin’s DeFi ecosystem. -

Compare differences between Bitcoin vs Litecoin. -

Track public companies that are holding Bitcoin.

How to keep your Bitcoin safe?

When transacting coins, you would typically be doing it on your personal computer. Since your personal computer is connected to the internet, it has the potential to be infected by malware or spywares which could compromise your funds.

Hardware wallets such as Trezor and Ledger are strongly encouraged in mitigating that risk. These are external devices that look like USB sticks. A hardware wallet secures your private key that holds your Bitcoin into an external device outside of your personal computer. When you intend to transact, you would connect the hardware wallet into your personal computer, and all the key signing in order to transact would be done in the hardware itself outside of your computer.

However, if you physically lose your hardware wallet without a key phrase backup, there is no other way of recovering your funds ever. As such when setting up your hardware wallet, always remember to keep a copy of the key phrase and put it somewhere safe from fire or flood.

Bitcoin Halving

Bitcoin Halving or sometimes also known as the Halvening, refers to the reduction of block reward to miners by half. This is part of its built-in monetary policy, in which after every approximately 4 years, the mining reward will be halved towards the limited capped supply of 21 million Bitcoin. Once 21 million of Bitcoin have been minted, there will no longer be new supply of it rewarded to miners, and miners are expected to earn revenue by way of transaction fees.

In order to follow the real time of when the halving will take place, you can bookmark the CoinGecko’s bitcoin halving page.

This is seen as a significant event for couple of reasons. Firstly, traders may speculate on the possible scarcity of Bitcoin making way to high volatility. Secondly, as miners’ rewards will be reduced, we may see some miners exiting the market as they could not sustain the lower profitability. This in turn may cause the hashing rate to reduce and mining pools may consolidate. Due to this, the bitcoin network may be a little unstable during the halving period.

Is Bitcoin a good investment?

We do not provide investment advice. The price of bitcoin started off as zero and made its way to the market price you see today. It appears that the market is placing value for the following reasons.

- Digital Gold – It is a viable digital store of value due to its digital scarcity

- Payment – Almost instant and low cost transaction with anyone on the internet

- Speculation – This may be due to inefficiency in the market, but there are people speculating that Bitcoin may be the asset class of the future

That being said, Bitcoin comes with risks. In order to determine for yourself if it is a good investment, it is important to understand the risk and only invest amount that you are comfortable losing.

There is a probability of Bitcoin price going to zero. This can happen if the project fails, a critical software bug is found, or there are newer more innovative digital currencies that would take over its place. If you recall Bitcoin was worth nearly $20,000 in 16th December 2017. But in 17th December 2018, the price of Bitcoin was at its low of about $3,200. Bitcoin is a highly volatile asset class and requires a high risk appetite.

As much as Bitcoin is a digital gold, it has only been around for about 10 years. In comparison to gold which has been a widely known store of value for over hundreds of years.

Can I short Bitcoin?

Yes, as bitcoin has grown to become more widely adopted, there are various derivative products being launched that allows you to short sell bitcoin. If you are an institutional investor, CME and Bakkt provide regulated bitcoin futures products which you can participate to long or short bitcoin. Alternatively, there are many other cryptocurrency derivative exchanges such as BitMEX, Binance Futures, FTX, Deribit, and more. These derivative exchanges are not formally regulated and can provide even up to 100x leverage. Derivative contracts are high risk products, you might want to understand what you are doing before participating in it.

24 hour trading pattern

7 Days trading pattern

14 Days trading pattern

30 Days trading pattern

90 Days trading pattern

180 Days trading pattern

One year trading pattern

Max Price chart

Bitcoin price today is $39,145.66 with a 24-hour trading volume of $33,883,906,113. BTC price is up 1.4% in the last 24 hours. It has a circulating supply of 19 Million BTC coins and a total supply of 21 Million. If you are looking to buy or sell Bitcoin, FTX.US is currently the most active exchange.

Bitcoin hit an all time high of $69,044.77 on Nov 10, 2021 (6 months).

Bitcoin had an all time low of $67.81 on Jul 06, 2013 (almost 9 years).

The 24 hour trading volume of Bitcoin is $33,883,906,113.

Join Our Telegram Group

Join Our Twitter [/s2If]

Join Our Telegram Group