[s2If !current_user_can(access_s2member_level4)]Please register to read full post. [lwa][/s2If] [s2If current_user_can(access_s2member_level1)]

Despite a previous decline of over 40 points, the S&P 500 has made a remarkable recovery as it is currently down by only 13 points. This is a positive demonstration for the bullish investors, particularly considering the continuous purchasing activity since the end of May.

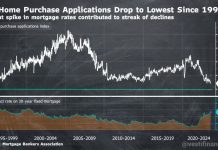

The concept I have been advocating since the beginning of the year is gaining traction in the market, which is that the US consumer is powerful and the 30-year fixed mortgage is a dominating force. Additionally, while the current Fed funds rate at 5.00-5.25% may pose a challenge at present and in the future months, this still provides the FOMC with the opportunity to reduce rates by 500 basis points in the future, which would be beneficial. This large room for maneuvering can be viewed as significant means of support.

It seemed like today would be a favorable time to sell and make some profits, but investors are feeling nervous about the rebalancing at the end of the quarter. However, those who are bullish on the market are not showing any willingness to wait. It appears that a lot of people have not participated in the recent uptrend and are eagerly waiting for any decline to make purchases.

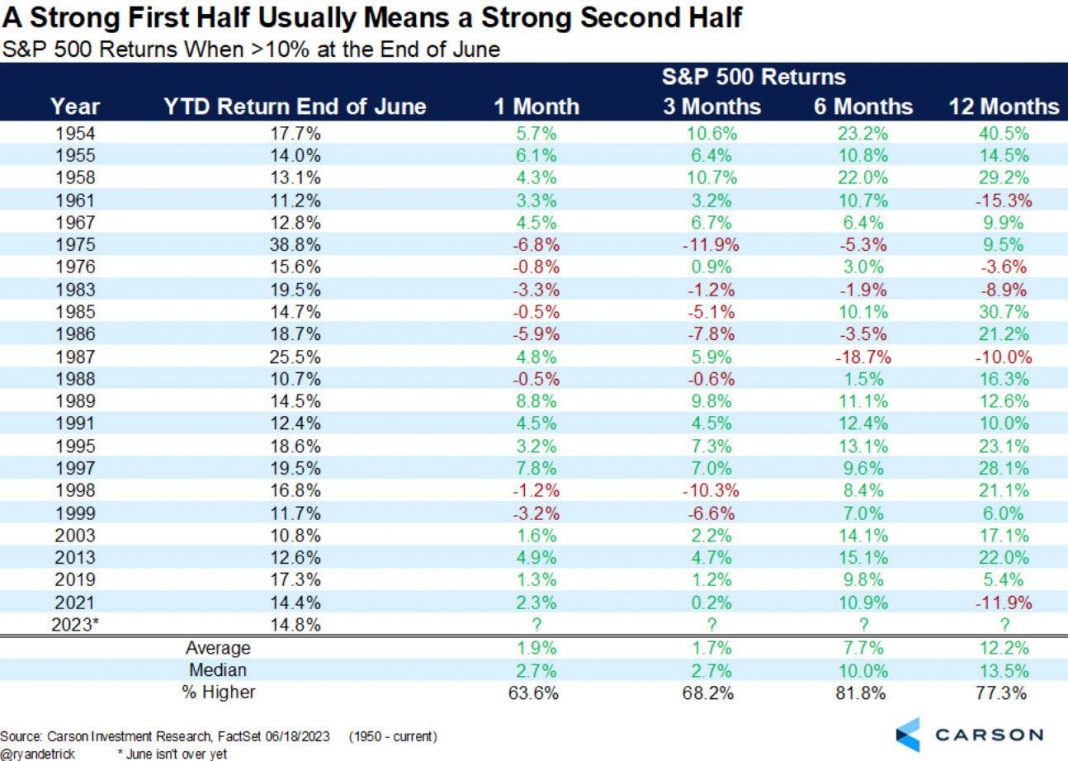

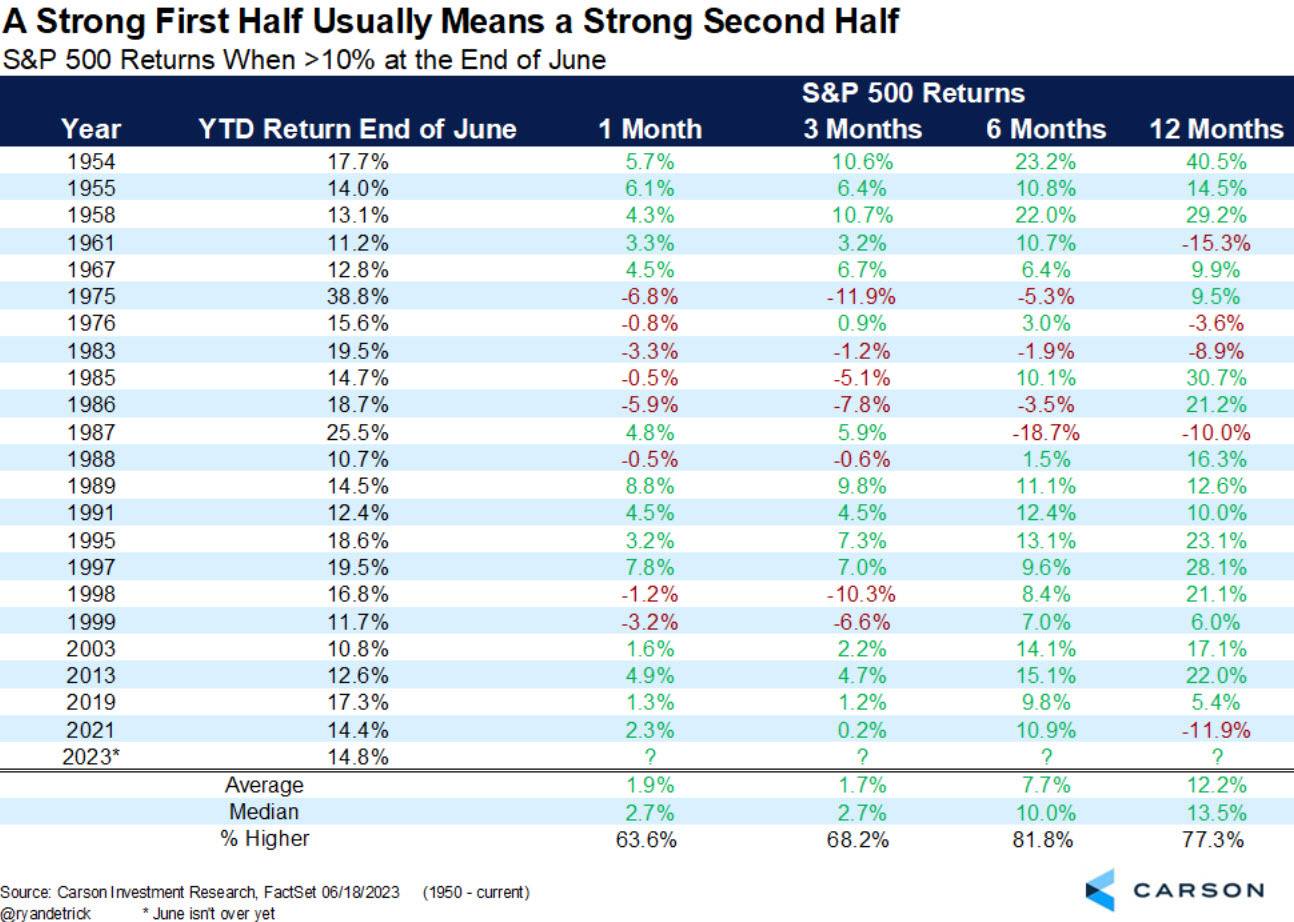

Ryan Detrick has highlighted that in cases where the S&P 500 has seen an increase of over 10% in the year-to-date period as of June, the final six months have shown a median increase of 10%. This implies that a robust performance in the initial half of the year usually results in a similarly successful performance in the second half, with an average increase of 10%.

[/s2If]

[/s2If]

Telegram Group