[s2If !current_user_can(access_s2member_level4)]Please register to read full post. [lwa][/s2If] [s2If current_user_can(access_s2member_level1)]

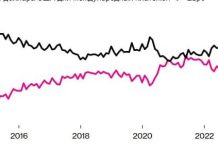

Gold is not finding much solace from lower bond yields, possibly due to a potential risk rotation occurring prior to the end of the month or quarter. Yesterday, the price of gold fell 0.7%, and the breaking of a crucial support level on the chart was even more significant. In the recent weeks, buyers had been using the 100-day moving average (red line) as a crucial reference point, but it has now been breached.

Although there is some indication of support from the 50.0 Fib retracement level of the upward movement between March and May 2021, located around $1,935.84, breaking the 100-day moving average gives sellers a favorable opportunity to look for more downward momentum.

The query is whether the current weekly flows are linked to the rotation play mentioned earlier. This could weaken the belief in a significant drop in the value of gold. Nevertheless, considering only the technical aspects, the conditions are favorable for sellers to initiate a downward trend.

The most significant potential hazard today is the testimony of Fed chair Powell before Congress, yet it is also recommended to monitor the inflation statistics from the UK.

The next major level to keep an eye on is $1,900 if the price drops in the upcoming sessions.

[/s2If]

Telegram Group