[s2If !current_user_can(access_s2member_level4)]Please register to read full post. [lwa][/s2If] [s2If current_user_can(access_s2member_level1)]

An increase in long-term US bond yields contributed to the USD/JPY reaching a new high for the year and surpassing a significant resistance level. The pair has risen by 36 pips today and briefly reached 142.45 due to widespread purchasing of the USD.

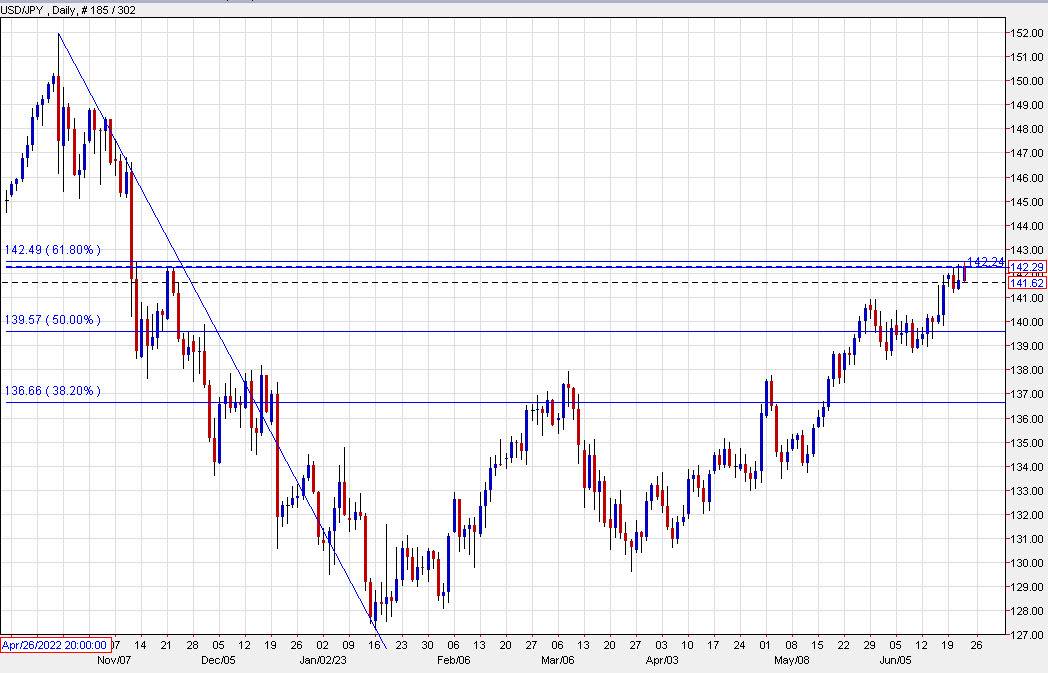

It’s valuable to look at the chart from a broader perspective since it emphasizes the significant levels currently in effect. The 142.24 level was reached in November 2022, and it showed a significant recovery after the fall following intervention and CPI peaks. Additionally, it is near the 61.8% retracement of the dip that occurred at the beginning of the year.

It can be argued that once USD/JPY surpasses these levels, it will have a straightforward journey back to the 150 region.

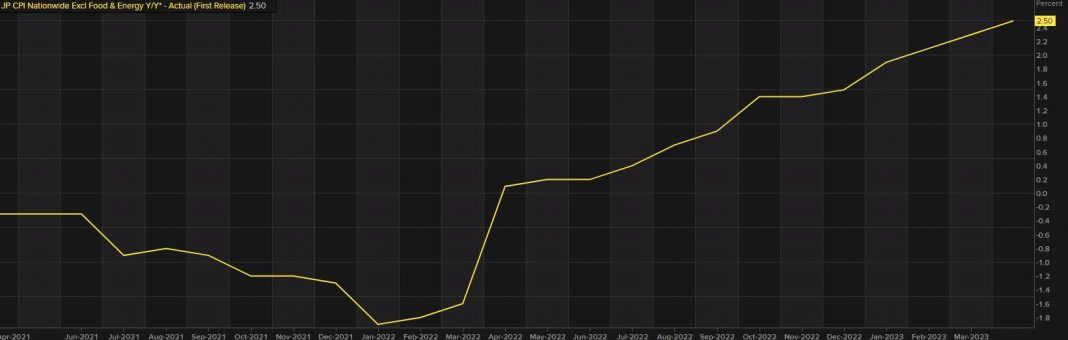

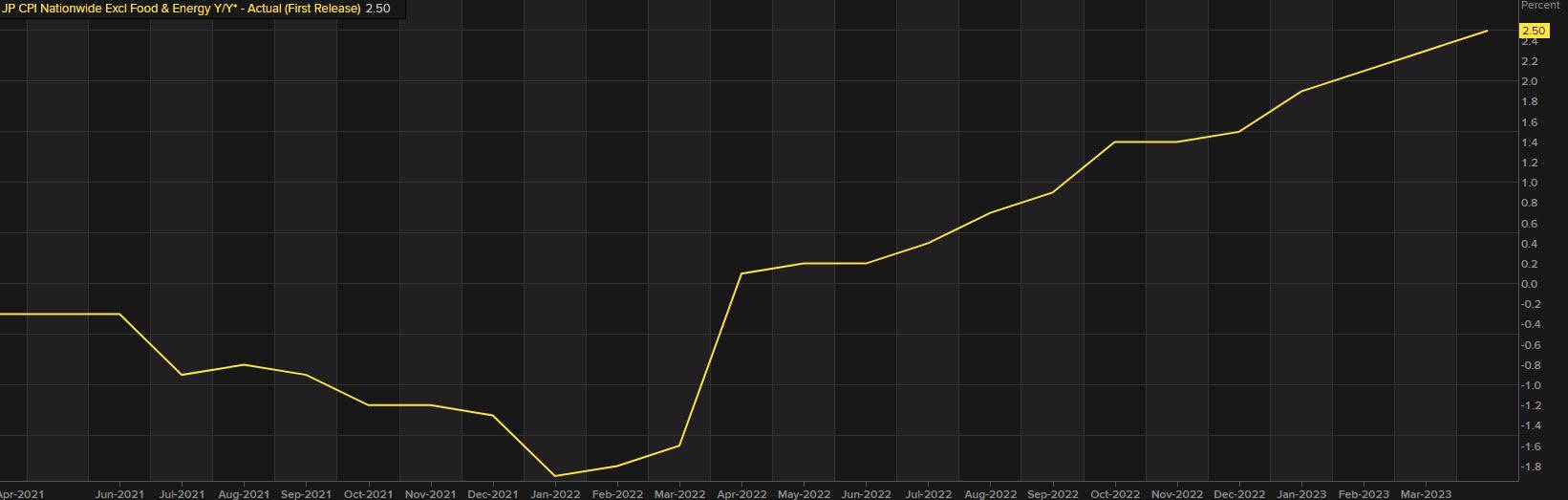

There is a significant chance of a potential danger regarding the idea of a stronger USD/JPY due to the likelihood that the Bank of Japan may have to relinquish their control over the yield curve. The rate of consumer price inflation is slowly increasing, and despite the Bank of Japan’s claims that there is deflation in the near future, a decreasing currency will not provide any assistance.

It’s important for traders to be aware that there could be a decline in risky investments which would negatively impact the USD/JPY exchange rate and increase the value of the yen overall if there is a surge towards safer investments due to market concerns related to a possible recession. Recently central bankers have been acting more forcefully which increases the likelihood of a recession in 2024. If there are indications of trouble on the horizon, then there is the potential for USD/JPY to experience difficulties.

It is worth mentioning that the optimal period to possess stocks is during the initial two weeks of July, which can provide an advantageous situation for USD/JPY.

[/s2If]

Telegram Group