[s2If !current_user_can(access_s2member_level4)]Please register to read full post. [lwa][/s2If] [s2If current_user_can(access_s2member_level1)]

“Forthcoming occurances:”

On Monday, the US will be observing Juneteenth as a holiday.

On Tuesday, the People’s Bank of China will announce the Loan Prime Rate.

On Wednesday, there will be the release of the UK CPI and Fed Chair Powell’s testimony.

On Thursday, events such as the SNB’s policy decision, BoE’s policy decision, and US jobless claims are expected to take place.

On Friday, there will be an announcement of PMIs for the United States by S&P Global.

On Tuesday, it is anticipated that the PBOC will lower the 1-year and 5-year LMP rates by 0.1% after already reducing the 7-day reverse repo, Standing Lending Facility, and 1-year MLF rates. These measures were implemented as a response to the Chinese economy performing poorly and officials seeking additional assistance for its growth.

On Wednesday, the UK’s Consumer Price Index Annual Percentage Rate is predicted to be 8.5%, down from the previous 8.7%. Meanwhile, the Core CPI Annual Percentage Rate is projected to be at 6.7%, which is slightly lower than the previous rate of 6.8%. Although this report arrives one day before the Bank of England’s interest rate decision, it is not anticipated to alter expectations for the upcoming meeting, as a rise of 25 basis points is already widely anticipated. Unless there are major surprises, this report is unlikely to influence expectations for the meeting.

It is expected that Fed Chair Powell will address Congress about the current status of US monetary policy. Since this testimony is only a week after his FOMC Press Conference and no significant economic data has been released during this time, it is doubtful that any new information will be presented.

On Thursday, it is expected that the SNB will raise its interest rate by 25 basis points, which would result in a rate of 1.75%. The decrease compared to the previous raise of 50 basis points is justified by the recent CPI data showing Headline CPI Y/Y at 2.2% and Core CPI Y/Y at 1.9%. Although the SNB is nearing its 0-2% target range, comments from Governor Jordan regarding inflation being more persistent than previously thought and the appearance of second and third round effects have caused the market to anticipate a 25 basis point increase at this meeting, which may even be the final one.

It is anticipated that the Bank of England will increase the bank rate by 25 basis points, resulting in a 4.75% rate. A rise has been expected due to high inflation and employment rates, with wages exceeding their target of 2%. It is predicted that two people will vote against the hike, so if one of them changed their vote to a raise, it would be viewed as unexpected. At present, the market anticipates that the final rate will be 5.25%.

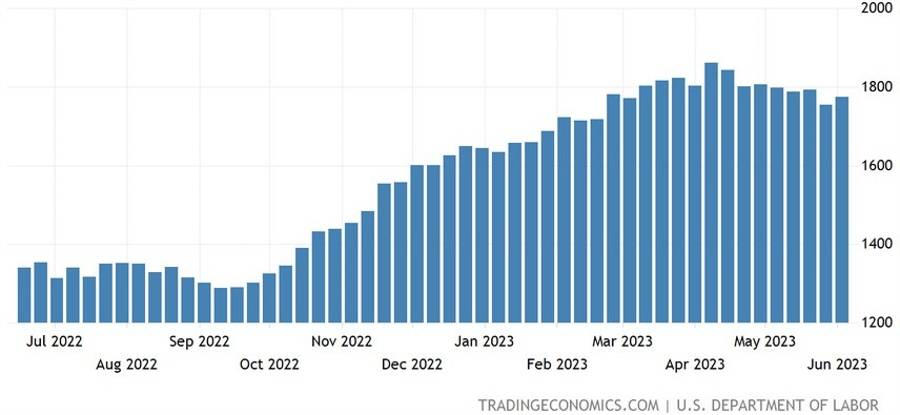

In recent weeks, the number of people filing for unemployment in the US has increased significantly, missing expectations by a significant amount for two consecutive weeks. However, the number of Continuing Claims (which indicates how challenging it is for people to secure jobs after being unemployed) has remained relatively stable. While there may be some indication of a slightly weaker job market, it is not enough to suggest an impending recession. It is anticipated that initial claims will be around 256K (compared to the previous 262K), with continuing claims at 1766K (compared to the previous 1775K).

Friday:

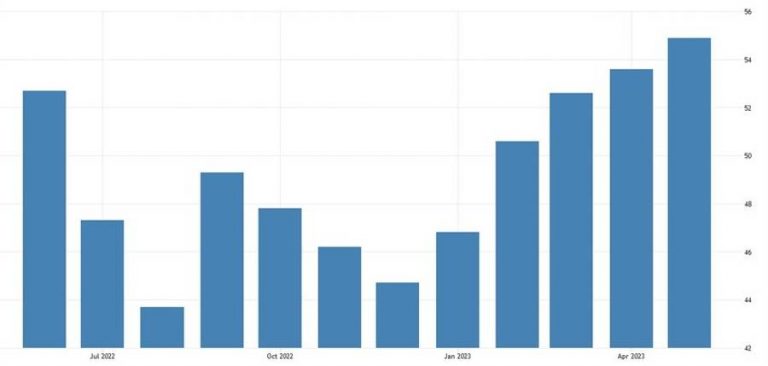

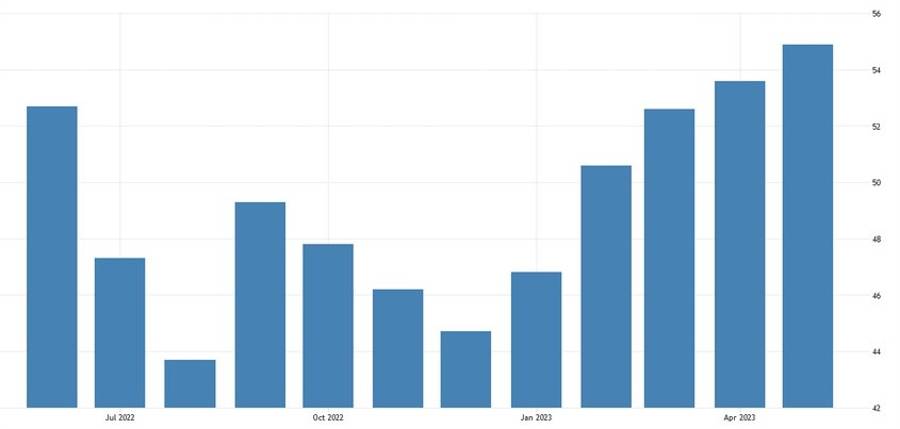

The S&P Global US PMIs might be the most important data point for this

week. The Manufacturing PMI is expected to print at 48.3 vs. 48.4 prior, while

the Services PMI is seen at 54.0 vs. 54.9 prior.

Wish you a profitable week!

[/s2If]

Telegram Group