[s2If !current_user_can(access_s2member_level4)]Please register to read full post. [lwa][/s2If] [s2If current_user_can(access_s2member_level1)]

Despite initially dropping more than 40 points, the S&P 500 has made an impressive recovery and is currently down only 13 points, which is a positive outcome for investors who hold a bullish stance. This rebound is particularly noteworthy considering the continued buying activity that has occurred since the end of May.

The idea that I have been stating since the beginning of this year is now becoming widely accepted in the market – that the US consumer is resilient and the 30-year fixed mortgage is a significant strength for the United States. Although the current interest rates of 5.00-5.25% may present some obstacles in the short term (for the rest of the year), they offer the FOMC the ability to lower rates by 500 basis points in the future. This signifies a considerable amount of potential flexibility.

Today appeared to be a suitable day to take advantage of the profits, and there seems to be apprehension about rebalancing before the quarter ends. However, the optimistic investors are losing their patience. It seems like a lot of people have failed to benefit from this upward trend and are waiting for an opportunity to purchase during a slump.

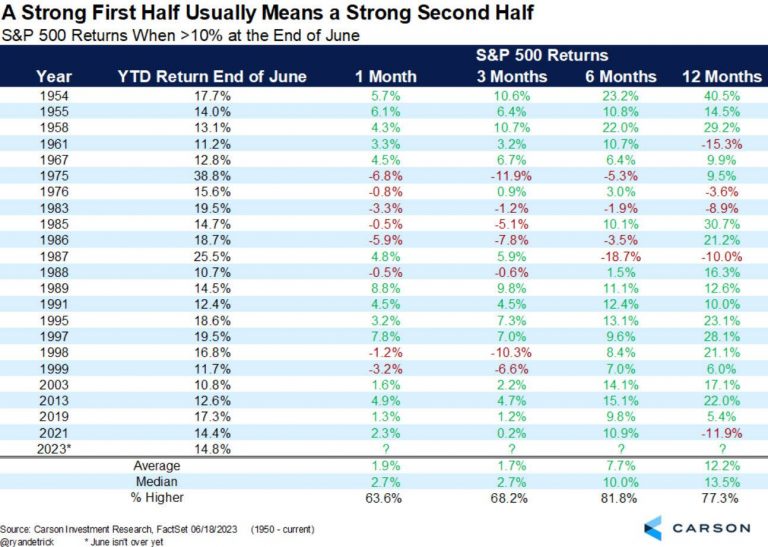

According to Ryan Detrick, if the S&P 500 has gained over 10% year-to-date by the end of June, there is a median increase of 10% in the following six months. Essentially, a strong start is usually followed by a strong finish, with an average growth of 10%.

[/s2If]

[/s2If]

Telegram Group