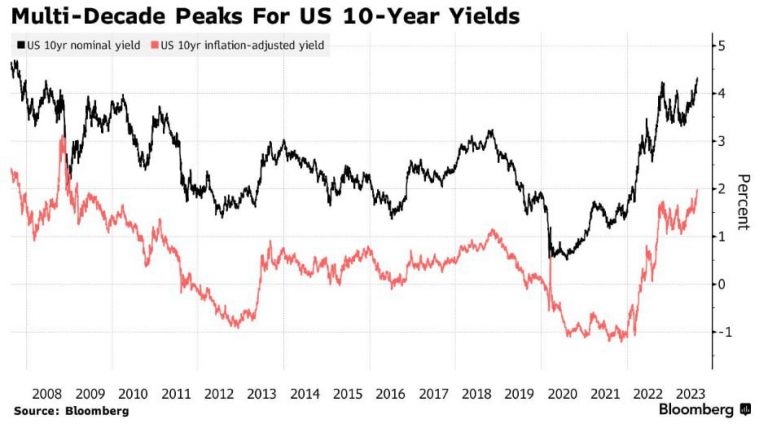

The US Treasury market experienced a renewed sell-off, causing 10-year bond yields to reach their highest point in 16 years. Additionally, the 10-year inflation-protected Treasury yield rose above 2% for the first time since 2009, compared to a low of approximately 1% earlier this year. Furthermore, yields on 10-year Treasuries without inflation protection reached 4.35%, surpassing the peak of October, while the 2-year yield briefly peaked at 5%. These debt sell-offs are occurring ahead of the annual Jackson Hole meeting, where Chairman Jerome Powell’s anticipated hawkish tone has instigated market expectations.